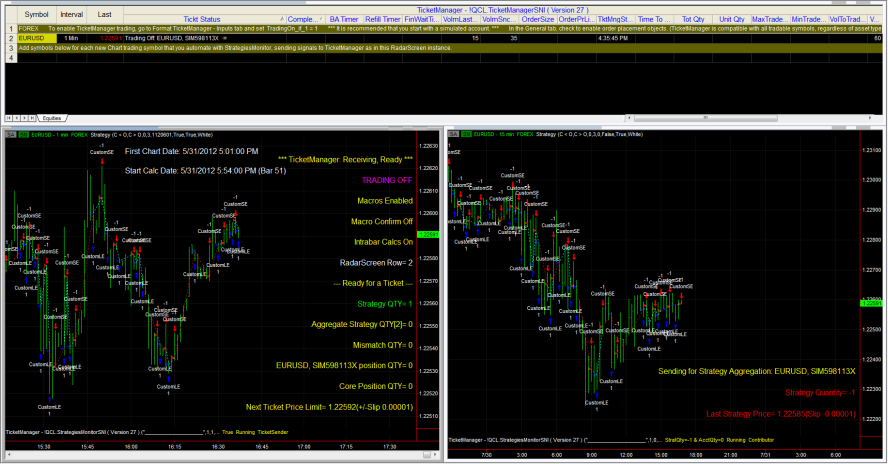

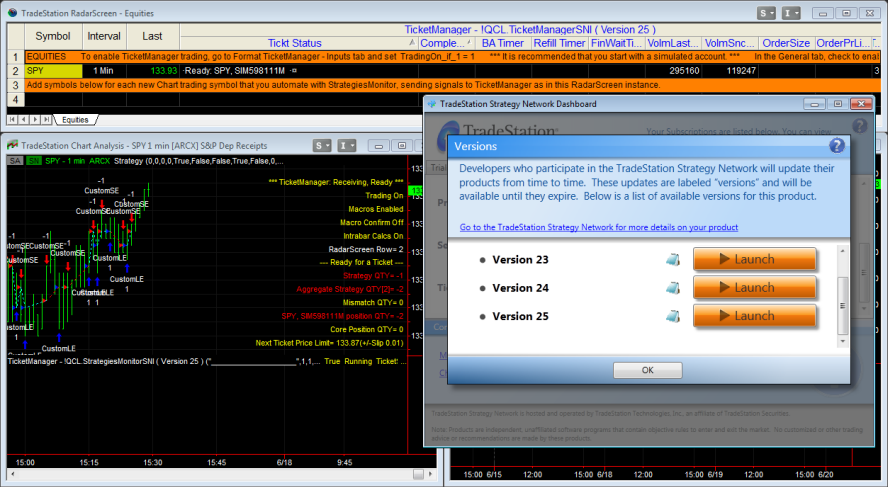

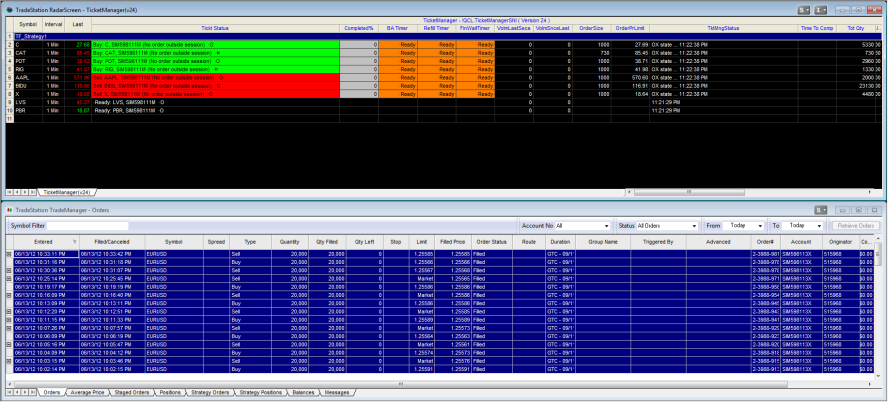

The TicketManager system available through the TradeStation Strategy Network is provided with the EquityCurveOptimizer. It is a tool that can both apply and be used to optimize equity-curve trading rules.

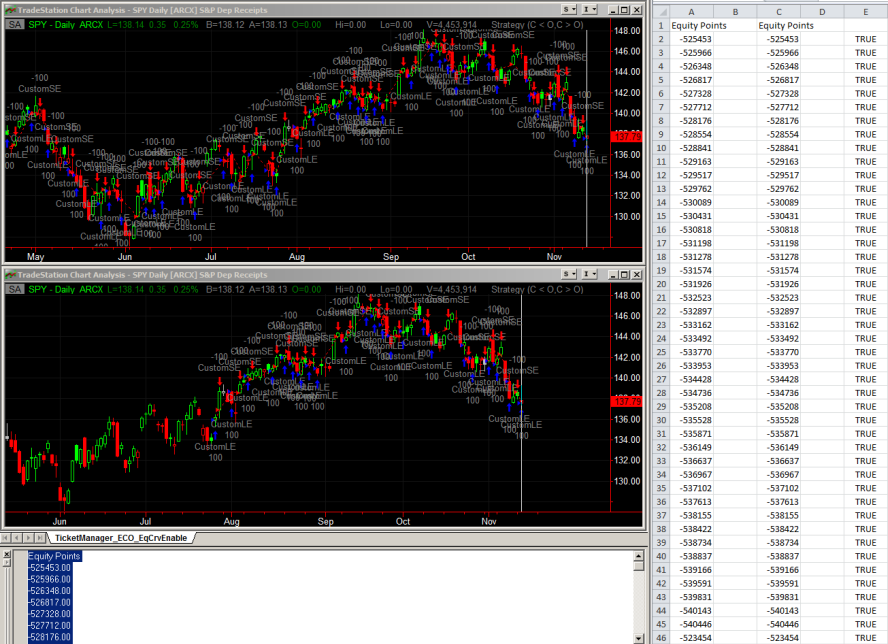

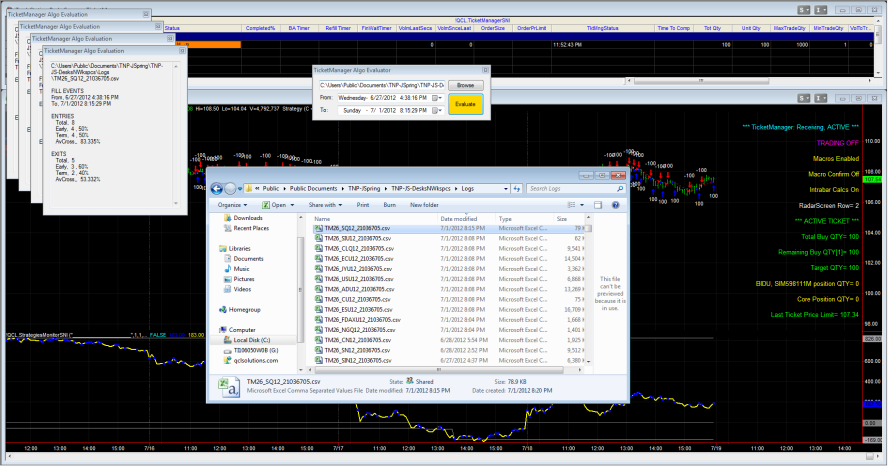

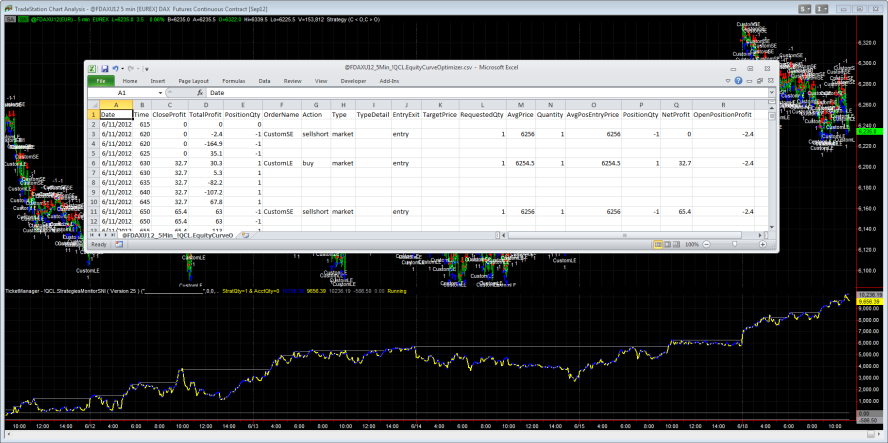

For instance, maybe you want a TradeStation strategy to stop trading once it has broken its lowest equity level of the most recent 5 equity points (recorded bar-by-bar, per exit trade, or for each trade). Then you want it to start trading again once its simulated performance has made a new high for the most recent 3 recorded equity points. This can be accomplished with the EquityCurveOptimizer without any special modifications of strategy code (EquityCurveOptimizer is a companion strategy that runs side-by-side with your strategies). EquityCurveOptimizer can be further used with the TradeStation strategy optimizing utility to find ideal equity-curve settings. Perhaps instead of the 5 and 3 settings example above, 10 and 7 would perform better. EquityCurveOptimizer can pinpoint such settings.

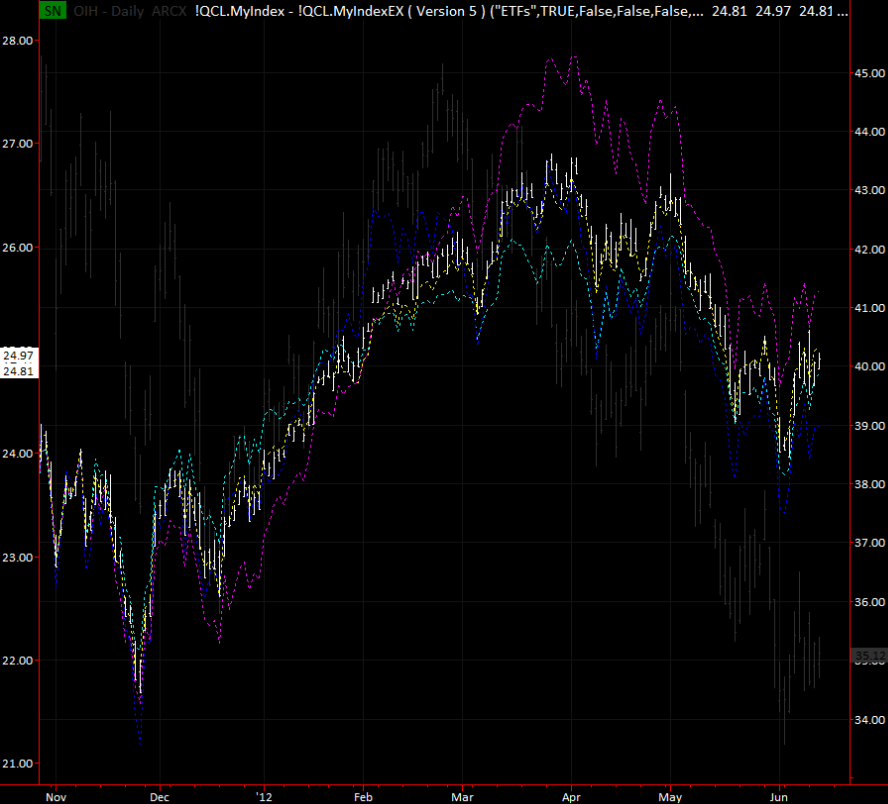

A classic automation problem for good systems is to know when to stop trading, since losing periods can be protracted. It may be that a systems stops working for a while, or that it stops working permanently. This can happen when the reasons that once made a strategy work, are overwhelmed by other forces, cease to exist or cease to impact markets as they once did.

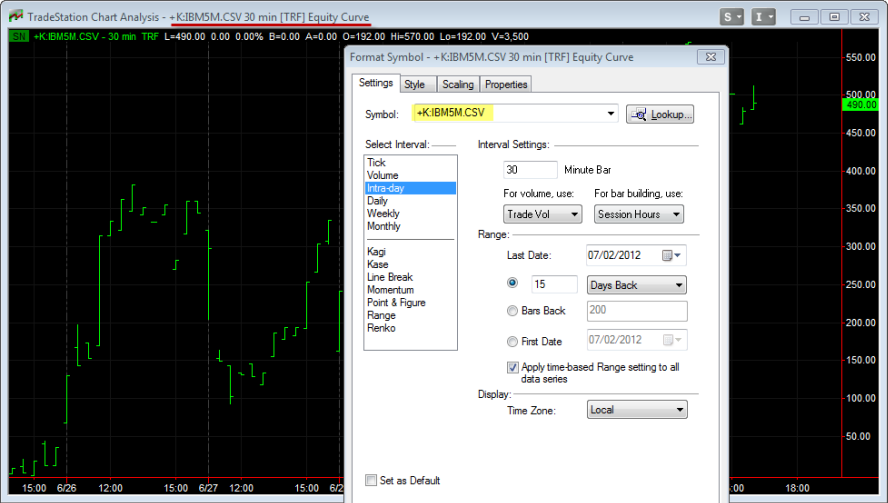

Take a look at the video by clicking on the image below, to see how the EquityCurveOptimizer can be used to cease trading in a system that has continued to make equity lows. The demonstration explains how a strategy can be operated in a long-history chart, to disable trading based on equity performance. Then this equity performance history can be extended into a short-history chart that would not have enough history on its own to disabled trading.

So in addition to illustrating equity-curve rules disabling a strategy, we also illustrate a technical feature of EquityCurveOptimizer that allows you to run your strategies with minimal cpu and memory resources, which can be important to power users.

EquityCurveOptimizer Equity Curve Extending

Please let us know if you have any questions by contacting us at [email protected].