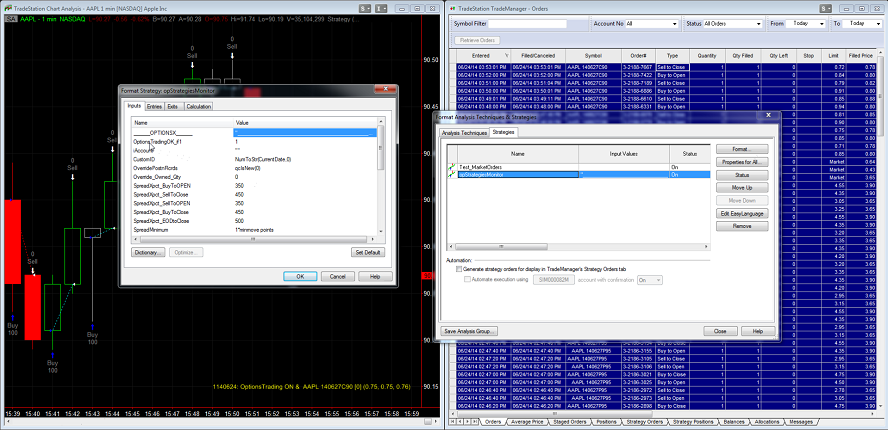

This video walks through demonstration code built with OptionsX components, for the TradeStation platform. The code is for a TradingApp window called TradeBotDemo which can be used with other applications like the earlier SymbolDataTable TradingApp to place orders and manage positions.

Browsing Posts published by admin

TicketTrader is for algorithmic trading. Say you want to enter or exit a position in AAPL but don’t want to place one large order. Rather, you want several orders over time following a plan to minimize market impact and/or improve your average trade price.

You may want to do this aggressively or passively, which typically depends on the market environment. So when setting your algorithmic inputs, it can be useful to view real time trading relative to current quotes. This is the purpose of the TicketTrader chart.

Note that the TicketTrader chart is optional. If you do not need it, you can hide it.

Format > TradingApp… > Inputs tab > set iBarsToChart = 0.

The chart initially loads symbol data but does not stream further real time data. This is to conserve resources until they are necessary. To the right of the chart, you should see a yellow button. When ready to view streaming data, press the button. Real time data will stream for 1 minute. Then the button will reappear for you to press if you need to view further real time data in setting up or adjusting your TicketTrader algorithm.

This video illustrates how to use the TicketTrader chart.

Please let us know if you have any questions.

[email protected]

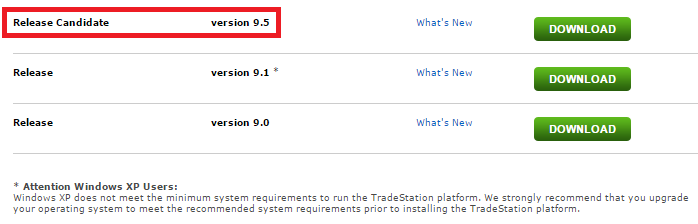

| Notice: As of this revision on 2016 August 9, TradeStation 9.5 is categorized by TradeStation as a “Release” product. The change of category from “Release Candidate” was made with, or soon after, the release of Update 14 on 2016 June 8. |

For TradingApp Store clients, we strongly recommend using TradeStation 9.1. Advanced products like OptionsX and TicketManager may not be installed properly by TradingApp Store processes in the 9.5 platform. Further, products with advanced functionality, such as TradeAssistant in its ability to respond when specified applications have placed orders, may not perform properly.

There are numerous issues with the 9.5 platform. So again if you are using subscription products, managing money, or are otherwise engaged in the serious business of trading, we strongly recommend using TradeStation 9.1.

TradeStation 9.5 is there for checking out the new bells and whistles. It’s cool. Have fun, but do your important work in TradeStation 9.1.

For more information, a description of release candidate software can be found on the following Wikipedia page: Software release life cycle.

TradeStation explains 9.5 as a release candidate here: community.tradestation.com/Discussions/Topic.aspx?Topic_ID=133834

Please let us know if you have any questions concerning our TradingApp Store products to which you are subscribed or are trying.

[email protected]

AutoBracketsFFX automates your TradeStation Futures and Forex Strategies to place each signal, with matching stop and limit orders paired in brackets. Have all your orders in the market for effective protection against disconnections and other interruptions, secure from system derailment, incomplete coverage and over-execution risks. Enjoy global controls, use with TicketManager, and more. Exploit the power and flexibility of EasyLanguage Strategies to place, pair and manage your orders your way with dialog-free fluidity.

Additional video demonstrations:

- Demostration of a Strategy with multiple entry brackets, automated by AutoBracketsFFX

- AutoBracketsFFX automation of your EasyLanguage

- AutoBracketsFFX with TicketManager

- AutoBracketsFFX secure from standard automation derailment risks

- AutoBracketsFFX secure from standard automation incomplete coverage risk

- AutoBracketsFFX secure from standard automation over-execution coverage risk

Please let us know if you have any questions.

[email protected]

TicketTrader is a TradeStation acclaimed product. TicketTrader, along with CTAllocator, are award winning TradingApps. They are professional tools for serious-minded traders. Even if you are not a professional trader, why settle for less? Every trade matters. Trade better with TicketTrader.

TicketTrader is designed for price improvement and market impact control through order slicing algorithms. TicketTrader allows you to step into target positions with multiple orders over time, limiting order quantities based on market activity, and enacting variably aggressive limit and stop prices relative to spreads. Use market orders or periodically convert to market when orders must fill. TicketTrader takes care of the details for you in trading and tracking application-owned positions.

TicketTrader features a unique tick chart reflecting the size and direction of trades. It finds valuable information in scattered ticks so you can anticipate where the market is likely to go. This is to help you make informed decisions as you manage positions.

Trading is at the heart of TicketTrader. It is much more than eye candy, TicketTrader is focused to secure trades that work for you. Especially if you trade with size, it can be vitally important to spread out over time, be patient for your price, scale your quantities relative to recent ticks, be variably aggressive, manage entries and exits differently, peg orders relative to inside quotes, employ multiple TicketTraders, etc. TicketTrader pursues best execution prices for you and your clients, by your rules, not simply hoping to get lucky or that a market maker won’t slip trades too much.

With just one buy or sell, TicketTrader can easily pay for itself. If you take your business serious with excellence and fiduciary responsibilities in mind, especially in light of the many forces working against fair executions, how can you not arm yourself?

A 10-day trial is free and doesn’t automatically roll into a subscription. Give it a test drive and see that TicketTrader puts you in control of your trades.

See the video below to get started:

We look forward to your trials and actively supporting subscribers. Let us know if you have any questions.

Video demonstrations:

&Puts(S)_WedWeeklys(1itm3xo)hl0.png)

&Puts(S)_WedWeeklys(1itm3xo)hl.png)

.png)