Generally we recommend the latest TradeStation release and updates. This gives our clients access to the latest bug fixes. Recently we had been anticipating Update 8 since it was to resolve a memory leak we found in the platform months ago. This TradeStation memory leak was an issue that could affect products like TicketManager when they run for long periods of time, like 10 hours or more, without a platform restart. (If you are concerned with the memory leak issue, we can resolve the issue even without the patch in Update 8.)

Update 8 was released this week and we have been actively testing. As a result, we do Not recommend the Update 8 patch. If you have already applied the Update 8 patch, you may rollback to Update 7. We have tested the rollback process many times. It is effective and resolves problems introduced by Update 8.

At this time we recommend using: TradeStation 9.0 through TradeStation 9.1 – Update 7, but no further. We will notify our clients here, as soon as we find it safe to apply further TradeStation 9.1 updates.

If you have already installed Update 8 and need assistance rolling back to Update 7, call for TradeStation Tech Support here: 800.808.9336

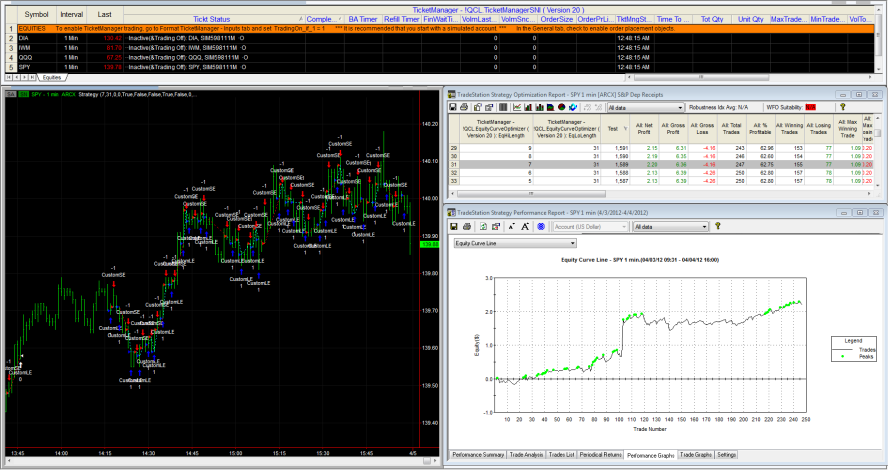

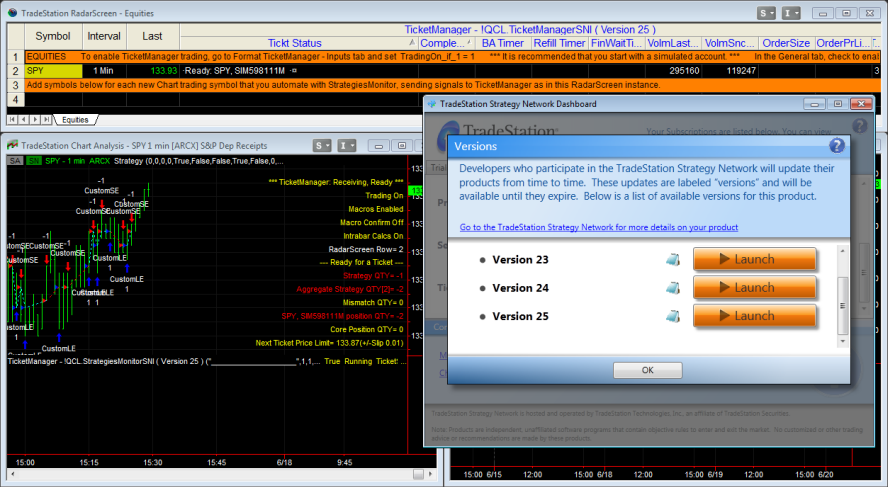

For a quick video, demonstrating how you may Roll-back to TradeStation 9.1 Update 7, click on the image below:

Roll-back to TradeStation 9.1 Update 7

June 15, 2012 notes

TradeStation 9.1 Update 10 is currently a Beta release. In testing, the issues introduced by Update 8 appear to be resolved. We will continue to test and let you know if anything changes. We look forward to a full release of TradeStation 9.1 Update 10+.

July 26, 2012 notes

TradeStation 9.1 Update 10 is now in full (i.e. production) release. We have tested TicketManager ( Version 27 ) extensively in Update 10 and performance is good. So we are now recommending that TicketManager (Version 27 ) clients apply the 9.1 patch. The issues introduced by Update 8 have not disappeared, but we have worked around them. If with any other application, you have trouble after applying Update 10, see instructions above for rolling back… TradeStation is already developing further updates for the 9.1 platform. We look forward to their release as they are to resolve issues reported on behalf of clients.