!QCL Solutions, LLC develops and deploys scalable software and hardware solutions for professional traders. !QCL Solutions is focused on extending high-end trading applications, automated systems, technical analyses, information access, computing and colocation services for investment managers to compete and grow. Technical solution for the serious business of electronic money management requires experience and discipline. We work with TradingApp subscribers and like-minded firms.

!QCL Solutions, LLC develops and deploys scalable software and hardware solutions for professional traders. !QCL Solutions is focused on extending high-end trading applications, automated systems, technical analyses, information access, computing and colocation services for investment managers to compete and grow. Technical solution for the serious business of electronic money management requires experience and discipline. We work with TradingApp subscribers and like-minded firms.

Sign up for products on the TradeStation TradingApp Store.

Below are featured solutions for TradeStation customers to trade effectively with scalable systems.

| TicketTrader Add-On | TicketTrader is designed for price improvement and market impact control through order slicing algorithms. TicketTrader allows you to step into target positions with multiple orders over time, limiting order quantities based on market activity, and enacting variably aggressive limit and stop prices relative to spreads. Use market orders or periodically convert to market when orders must fill. TicketTrader takes care of the details for you in trading and tracking application-owned positions. |

| TicketManager Add-On | Professional Algorithmic Auto-Trading of TradeStation Strategies with robust scalable operations for price improvement and market impact control. TicketManager aggregates and manages all your strategies. Equity-curve optimize and automate, unleash the power of RadarScreen trading, and more. Don’t get bogged down with alarms trying to keep your strategies synchronized. Break free to focus your business forward. For enhanced algorithmic management, TicketManager integrates MDVelocity data feeds. |

| AutoBrackets Add-On | Automate your TradeStation Strategies to place each signal, with matching stop and limit orders paired in brackets. Have all your orders in the market for effective protection against disconnections and other interruptions, secure from system derailment, incomplete coverage and over-execution risks. Enjoy global controls, use with TicketManager, and more. Exploit the power and flexibility of EasyLanguage Strategies to place, pair and manage your orders your way with dialog-free fluidity. |

| MDVelocity Add-On | MDVelocity focuses on newest indications of buy and sell interest available in the market, so that trading systems can gauge where future trades may happen. Current inside bid and ask quotes can be old and misrepresent trading interests. Rolling period volume weighted averages of incoming quotes better indicate supply demand forces. Go beyond mere prices, quantities and levels, with rate and recency of incoming quotes fully considered. Automatically integrates with TicketManager algo trading for enhanced price improvement and market impact control. Find real value in market depth with MDVelocity. |

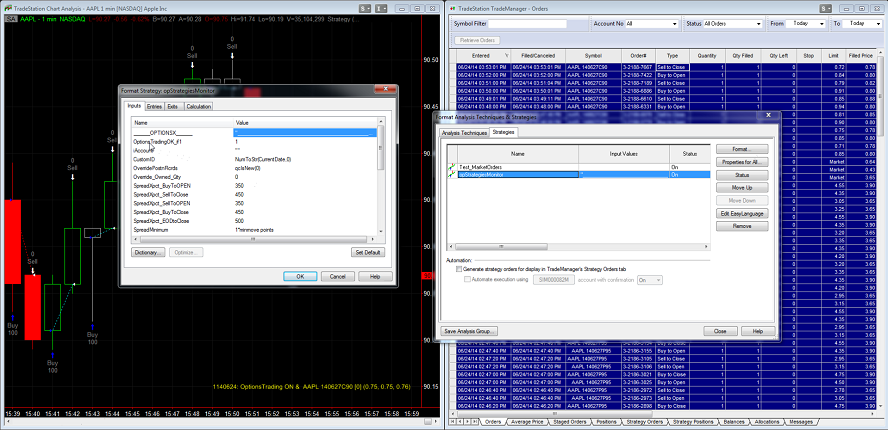

| OptionsX Add-On | OptionsX is a toolset for automated options trading relative to underlying symbols in TradeStation Charts and RadarScreen. It is designed for traders looking to enhance the buying power and profit potential of their strategies through options. Turn any strategy into an automated options trading system easily with opStrategiesMonitor. Even automate options trading for lists of underlying symbols with opMPTrader in RadarScreen. |

| This website is not meant to provide investment or trading advice. Any decisions you make based upon information contained in this website, or through links, are done solely at your own risk.

References to investment and trading performances should not be construed as recommendations of any investment or trading methodology. Past performance of any investment or trading methodology is no guarantee of future results. If you choose to trade, be aware that risk of loss can be substantial. Leveraged trading such as through options, futures, and forex exposes traders to heightened risk. Furthermore, traders may sustain losses greater than their investments, regardless of which asset classes are traded. Before trading, carefully consider inherent risks in light of your financial condition. |

&Puts(S)_WedWeeklys(1itm3xo)hl0.png)

&Puts(S)_WedWeeklys(1itm3xo)hl.png)

.png)