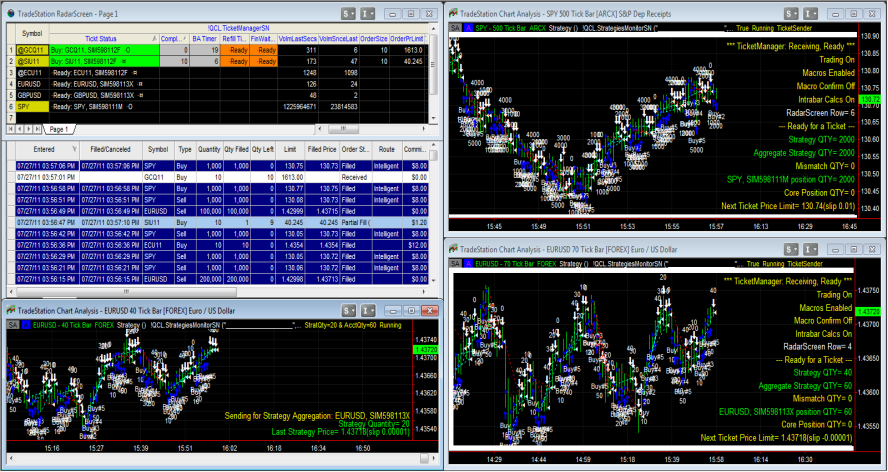

Professional Algorithmic Auto-Trading of TradeStation Strategies for robust scalable operations with market impact control. TicketManager aggregates and manages all your strategies. It is like having a full-time trading team. Don’t get bogged down with Automation warnings, trying to keep your strategies synchronized. Break free and focus forward, finding opportunities and new strategies that will keep your trading business ahead of the pack.

Click on the image for video: TicketManager for TradeStation 9

Now available on the TradeStation Strategy Network.

Once you have subscribed to the TicketManager product, download the demonstration workspace here:

July 26 2012 Note: The downloadable workspaces are saved in the TradeStation recommended: TradeStation 9.1 Update 10

TicketManager ( Version 27 )

(for use with SIMULATION Accounts)

Here is the same demonstration workspace with a Forex symbol applied, since some customers don’t have Equity data:

TicketManager ( Version 27 ) Forex

And as a subscriber, if you need help setting up TicketManager to trade your TradeStation strategies, contact us at [email protected]. We can get you started with institutional-level execution of your strategies, quickly.