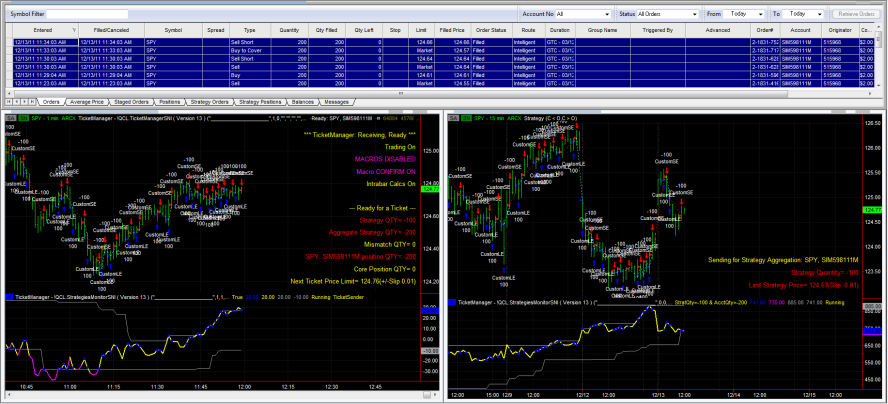

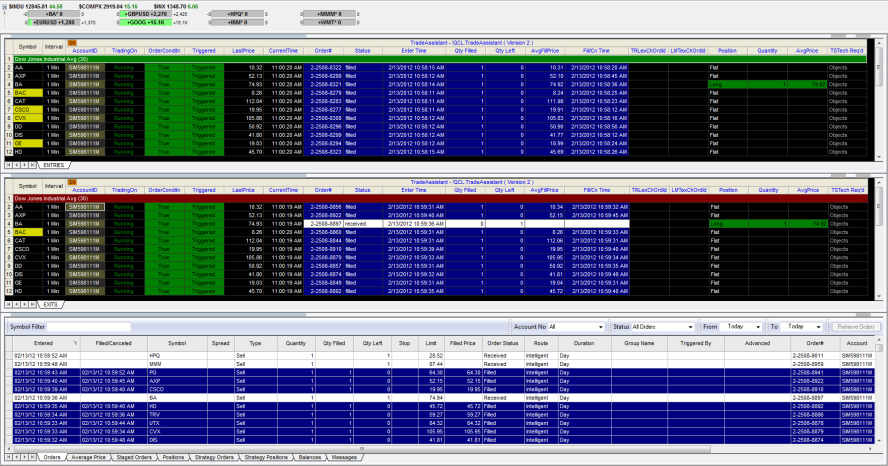

TradeAssistant is designed to be a fast and flexible order placement tool. Use it in RadarScreen with 100’s of symbol and custom triggers for each. Put orders in OCO groups to leverage buying power. Create OSO relationships and brackets. Check the status of orders and positions at a glance. TradeAssistant can be used in charts to quickly set multi-symbol order triggers. TradeAssistant is automation for the discretionary trader.

TradeAssistant Pro features the WATS application to access and automatically trade advisor signals. If you are using TradeAssistant Pro, try this demonstration signal file (for simulated accounts) with the WATS_Docker indicator, found in the default “Launch” workspace:

TradeAssistant WATS TradingApp demo file

Login here for your WATS files:WATS

Note that WATS_Docker is the same application as the WATS TradingApp, but hosted in a Chart as an indicator. For placing potentially large lists of interrelated orders, as with the WATS application, Chart and RadarScreen windows offer the best environments. The TradingApp window environment is to be improved in a coming release of TradeStation (expected to be in 9.5). Until then, use WATS_Docker for trading.

For both TradeAssistant and TradeAssistant Pro, here are two videos demonstrations of placing large lists of orders with the original !QCL.TradeAssistant indicator in RadarScreen:

Video demonstration, TradeAssistant ( Version 1 )

Video demonstration, TradeAssistant ( Version 2 )

Sign up for TradeAssistant on the TradeStation Strategy Network