Question: A customer stated that he was using OwnData to import custom daily data from Yahoo to TradeStation. He said that he could not get it to work and asked for help. Is there an easy way?

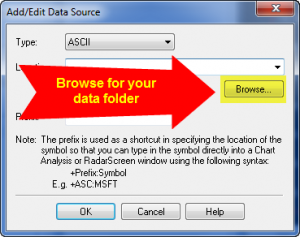

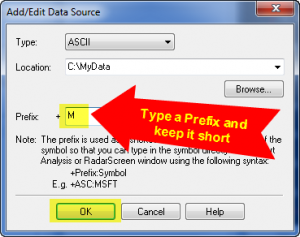

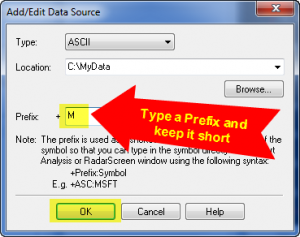

Answer: Yes. I have used OwnData and it is a fine product, but not a necessary one for the task. I regularly do this myself with various sources of daily data. I’ve found the easiest solution is to create daily data files in csv format (so they can be easily edited in Excel), save them in a predefined folder structure, and create or add to an Attributes.INI file in each respective folder (telling TradeStation how to interpret the data files). The only operation necessary in TradeStation is to assign a symbol prefix that works with each Attributes.INI file.

Instructions below are based on a demonstration folder called “MyData”.

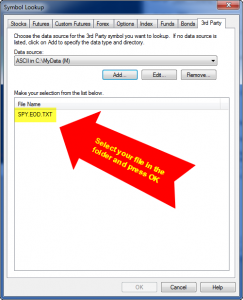

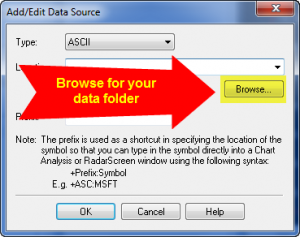

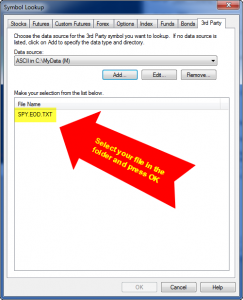

It contains an example daily data file for SPY from the Yahoo site. Along with it is the necessary Attributes.INI file. Download and unzip the folder. Place it where you can locate it easily, as in the root directory of your C-drive, i.e. at “C:\”. Then follow these instructions for using the 3rd-party data file for the first time in TradeStation:

Once you have created a prefix, any new data files that are of the same format, can be added to the folder with the correct Attributes.INI file. Simply add a description line for the new data file in the Attributes.INI file, and TradeStation can use it, without having to create another prefix or go through the new-symbol setup process.

Generally when there are problems reading new data, it is related to data being out of sequence. The left columns of the data file for Date and Time must be chronologically ordered from oldest to newest going from top to bottom.

Regards,

David O’Dell